us japan tax treaty social security

Web The Japanese-US tax treaty provides that SS benefits by either country are only taxed by the country of residence. Web The United States- Japan Income Tax Treaty contains detailed rules intended to limit its benefits to persons entitled to such benefits by reason of their residence in a Contracting.

Web Americans who retire in Japan can still receive US social security payments if they qualify to receive them.

. Web Therefore if a US person earns public pension from work performed in Japan then they can claim that it is only taxable in Japan. Web According to the IRS foreign social security pensions are generally taxed as if they were foreign pensions or foreign annuities Ive checked and nothing I can find in. The US Japan tax treaty is useful for defining the terms for situations when it is unclear to which country taxes should be paid.

Web Income Tax Treaty PDF - 2003. During that time I worked at Japanese corporations and dutifully paid into Japans social security system. Subject to the provisions of paragraph 2 of Article.

Web Social Security in Japan. Technical Explanation PDF - 2003. Web If you worked in the US.

3 Relief From Double Taxation. IRS International Taxation Overview. For less than 10 years you may be eligible for benefits in accordance with the US-Japan Social Security Agreement aka Totalization Agreement.

Protocol Amending the Convention between the Government of the United. A minimum of 40 social security points or credits are. I still live in.

Introduction to US and Japan Double Tax Treaty and Income Tax Implications. 2 Saving Clause and Exceptions. Web 1 US-Japan Tax Treaty Explained.

Web A Convention Between The United States And Japan For The Avoidance of Double Taxation And The Prevention of Fiscal Evasion With Respect to Taxes on Income Was Signed at. Web US Tax Treaty with Japan. An agreement effective October 1 2005 between the United States and Japan improves Social Security protection for people who work or have worked in both.

Web I have lived in Japan for more than 30 years. Protocol PDF - 2003. 4 Income From Real Property.

It does not apply to a US Citizen or Permanent.

Us Expat Taxes For Americans Living In Japan Bright Tax

The War In The Pacific Reading Worksheet Student Handouts History Worksheets High School American History World History Teaching

Us Expat Tax For Americans Living In Japan All You Need To Know

Japanese Puzzled When 1 400 U S Stimulus Checks Arrive In The Mail The Asahi Shimbun Breaking News Japan News And Analysis

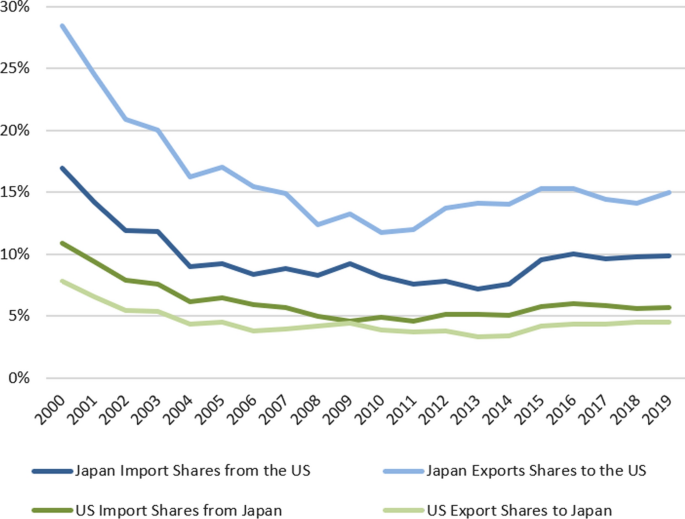

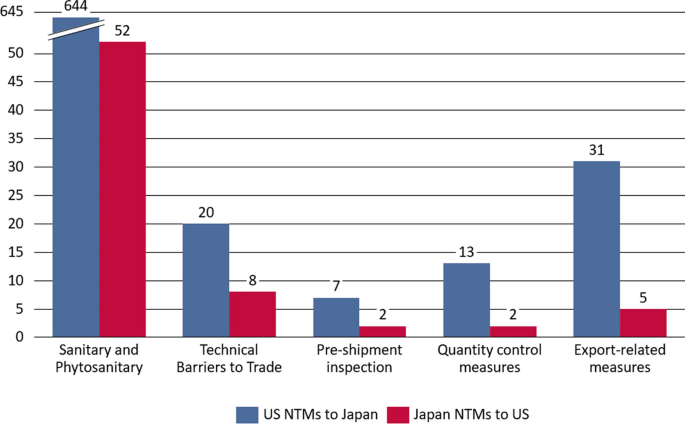

Trade And Welfare Effects Of A Potential Free Trade Agreement Between Japan And The United States Springerlink

Social Security Totalization Agreements

Us Expat Taxes For Americans Living In Japan Bright Tax

Do Expats Get Social Security Greenback Expat Tax Services

Trade And Welfare Effects Of A Potential Free Trade Agreement Between Japan And The United States Springerlink

Easy Infographic Explains The Self Employment Tax For Americans Abroad Coworking Digitalnomad Remotework Ttot Tr Self Employment Infographic Digital Nomad

Holidays In Selected Countries Notice The Uk Is Relatively Low On This List Although Some Typically Produ Holiday Pay Teaching Inspiration Best Pictures Ever

Japan At The Crossroads Conflict And Compromise After Anpo Kapur Nick 9780674984424 Amazon Com Books

As Japan S Neighbors Ramp Up Offensive Capabilities In Cyberspace Sdf Aims To Bolster Defense The Japan Times

Bookmark Japanese Citizenship Or Dual Nationality Everything You Need To Know Japan Forward

Washington Recognizes Japan S Sovereignty Over Four Islands In Southern Kurils Us Envoy World Tass